Самое актуальное и обсуждаемое

Популярное

Полезные советы

Важно знать!

Расширение файла cdw

Формат CDW – чем открыть файлы с расширением CDW, просмотрщик Компас, viewer

CDW – это расширение, которое относится к типу программ для разработки инженерных проектов. Само расширение является форматом...

Читать далее

Газпромбанк: вход в личный кабинет

Гб, мб, кб — это единицы измерения информации, а чем они друг от друга отличаются?

Как открыть эквалайзер в windows 10

Fast boot настройка биос

Финам: вход в личный кабинет

Скачивание программы финам трейд

Рейтинг смартфонов 2020 (декабрь) цена качество

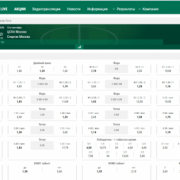

Графики форекс в режиме онлайн

Фьючерс (фьючерсный контракт)

Лучшее

Важно знать!

Какой samsung galaxy лучше

Лучшие до 20000 рублей

Во многом телефоны ценовой категории до 20000 рублей отличаются от более доступных незначительно улучшенными параметрами и в большей степени приятными и полезными опциями.

Samsung...

Читать далее

Отмечаем человека в тексте поста или записи вк — все способы

Горячие клавиши и комбинации для перезагрузки компьютера или ноутбука с клавиатуры

4 быстрых способа сделать гиперссылку в ворде на всех версиях офиса

Как с компьютера с ос windows 10 можно удалить вторую операционную систему

Способы, как убрать область исправлений в «ворде»

Как убрать замазанное на картинке и вернуться к оригинальному изображению?

Как правильно удалить любую игру и как удалить все файлы от нее. удаление с помощью revo unistaller

Как привязать инстаграм к вк через телефон

В каких айфонах есть nfc модуль

Обсуждаемое

Важно знать!

Непечатаемые символы в word

Знаки абзацев и другие символы форматирования в Word 2010

Одно из основных правил для правильного создания документов в Word – правописание. Не поймите неправильно, так как это не имеет ничего общего...

Читать далее

5 лучших линеек ноутбуков для web разработки в 2020 году

Способы исправления ошибки windows ntdll.dll

Дистанционные онлайн курсы обучения интернет профессиям и заработку через интернет в 2020 году

Инвестиции для начинающих

Одноклассники моя страница

Символ переноса строки в excel

Perfect money вход в личный кабинет, регистрация

16 лучших недорогих планшетов 2020

Всё про матрицы монитора: tn, ips, pls, va, mva, oled

Актуальное

Важно знать!

11 доступных движков для тех, кто хочет начать создавать свои игры

скачать приложение для создания игр CryEngine

CryEngine – это кроссплатформенный игровой движок для проектов стационарных платформ (ПК, консолей). Он распространяется по бесплатной модели, с роялти при...

Читать далее

Рейтинг 10 лучших телефонов-раскладушек! новинки 2019

Топ-10 смартфонов samsung 2020, рейтинг по цене/качеству

Что такое рефинансирование кредита и как рефинансировать кредит других банков + лучшие предложения 2019

Как найти среднеквадратическое отклонение в excel

Статусы в вк красивым шрифтом

Где дешевле ипотечное страхование

Support.apple.com/iphone/restore на экране — как убрать

Как в windows 10 открыть параметры папок

Тестовый режим windows 10

Обновления

Без рубрики

IoT взаимодействие с ERP и CRM: максимизация эффективности вашего бизнеса

Без рубрики

IoT взаимодействие с ERP и CRM: максимизация эффективности вашего бизнеса

В современном мире, где технологические решения проникают во все сферы жизни, концепция Интернета вещей...

Без рубрики

Скины CS:GO, CS2, Dota2: разновидности

Без рубрики

Скины CS:GO, CS2, Dota2: разновидности

В мире онлайн-игр, где виртуальная реальность сливается с соревновательным духом, роль индивидуального...

Без рубрики

Заработок в CS:GO и Dota 2: механизмы и возможности

Без рубрики

Заработок в CS:GO и Dota 2: механизмы и возможности

CS:GO и Dota 2, две популярные многопользовательские видеоигры, не только предоставляют захватывающие...

Без рубрики

5 эффективных способов использования телеграм аккаунтов для привлечения и удержания аудитории

Без рубрики

5 эффективных способов использования телеграм аккаунтов для привлечения и удержания аудитории

В наше время социальные медиа играют огромную роль в коммуникации и бизнесе, и одной из популярных...

Без рубрики

Разработка ПО для Astra Linux, ROSA, РЕД ОС, Аврора: экспертное руководство

Без рубрики

Разработка ПО для Astra Linux, ROSA, РЕД ОС, Аврора: экспертное руководство

Разработка программного обеспечения для отечественных операционных систем: преимущества и особенности

В...

Без рубрики

Youtube — новые посты

YouTube — видеохостинг, предоставляющий пользователям услуги хранения, доставки и показа видео. YouTube...

Без рубрики

Банк точка: вход в личный кабинет

Без рубрики

Банк точка: вход в личный кабинет

Интерфейс и дизайн Точка Банк

После успешной авторизации перед Вами откроется главная страница интернет-банка,...

Точка банк: вход в личный кабинет

Точка банк: вход в личный кабинет

Другие способы контакта с банком Точка

Телефонная горячая линия часто не устраивает клиентов банковских...

9 лучших жестких дисков для ноутбуков

Отличия между HDD и SSD

Сколько бы ни было свободного места на диске, его всё равно со временем будет...

Без рубрики

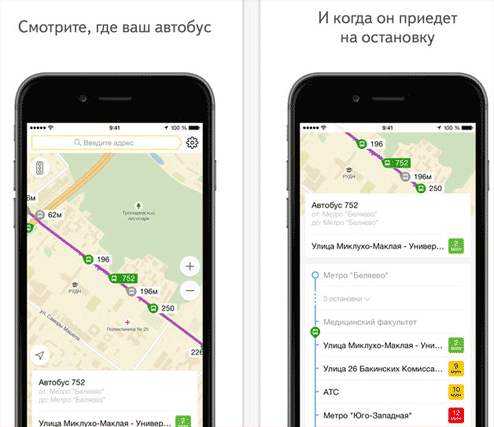

Яндекс транспорт новосибирск

Транспорт онлайн Новосибирск – сервис предоставляющий информацию о маршруте автобусов, трамваев, троллейбусов...

Без рубрики

Яндекс транспорт владимир

Сервис Яндекс транспорт Владимир дает возможность наблюдать онлайн за передвижением общественного транспорта...

Без рубрики

Wix

Шаг3. Финиш Wix.com вход в аккаунт. Свой домен и премиум

http://ваш_логин.wix.com/название_сайта

Это,...